Insights is a new weekly series featuring entertainment industry veteran David Bloom. It represents an experiment of sorts in digital-age journalism and audience engagement with a focus on the intersection of entertainment and technology, an area that David has written about and thought about and been part of in various career incarnations for much of the past 25 years. David welcomes your thoughts, perspectives, calumnies, and kudos at david@tubefilter.com, or on Twitter @DavidBloom.

This installment of Insights is brought to you by Beachfront RISE.

This might be the greatest time ever to be a sports fan. Really.

Subscribe for daily Tubefilter Top Stories

Notwithstanding the controversy-dogged Rio Olympics grinding into gear this week, consider: Traditional leagues are swimming in TV money as they expand to new platforms and fan experiences. Meanwhile, more sports than ever are finding a global audience and new technologies promise to transform how we watch and take part in athletics.

Let’s start with those leagues. As one example, in July, the NBA salary cap for players jumped 36%, to $94 million, thanks to a lucrative new TV deal that made even mediocre players with good timing very rich people. Like the other big leagues, the NBA has cashed in on network efforts to lock up sports rights with multi-billion-dollar deals through the early 2020s.

The reason? In an era of DVRs, cord-cutting and video on demand, few traditional TV offerings still command an appointment-watching audience like a sports event.

As one giant example, the 2016 Super Bowl was watched by 111.9 million people in the United States, which Nielsen said makes it the third-most-watched U.S. broadcast ever (a record 114 million watched the 2015 game). Notably, a record 1.4 million people per minute watched the 2016 game through various online streams, up from 800,000 the previous year.

But even a mediocre midweek NBA or Major League Baseball game can still command an audience, filling blocks of a network schedule with a reliable audience beloved by big-dollar advertisers like mobile phone, beer, and car companies. Sports audiences typically don’t skip ads or record the game to watch three days later, either. Only awards shows and reality competitions can claim the same kind of viewership habits.

And, in a minor irony, as more people disconnect from cable and satellite subscriptions, the remaining audiences get more valuable. That’s why television networks saw a big bump up in spending at this year’s advertising upfronts after years of decline. But as even mighty ESPN watches cord-cutters shrink its subscriber base by 10 million over three years, and regional sports networks struggle with shrinking cable bundles, digital media companies are jumping into a new sports opportunity.

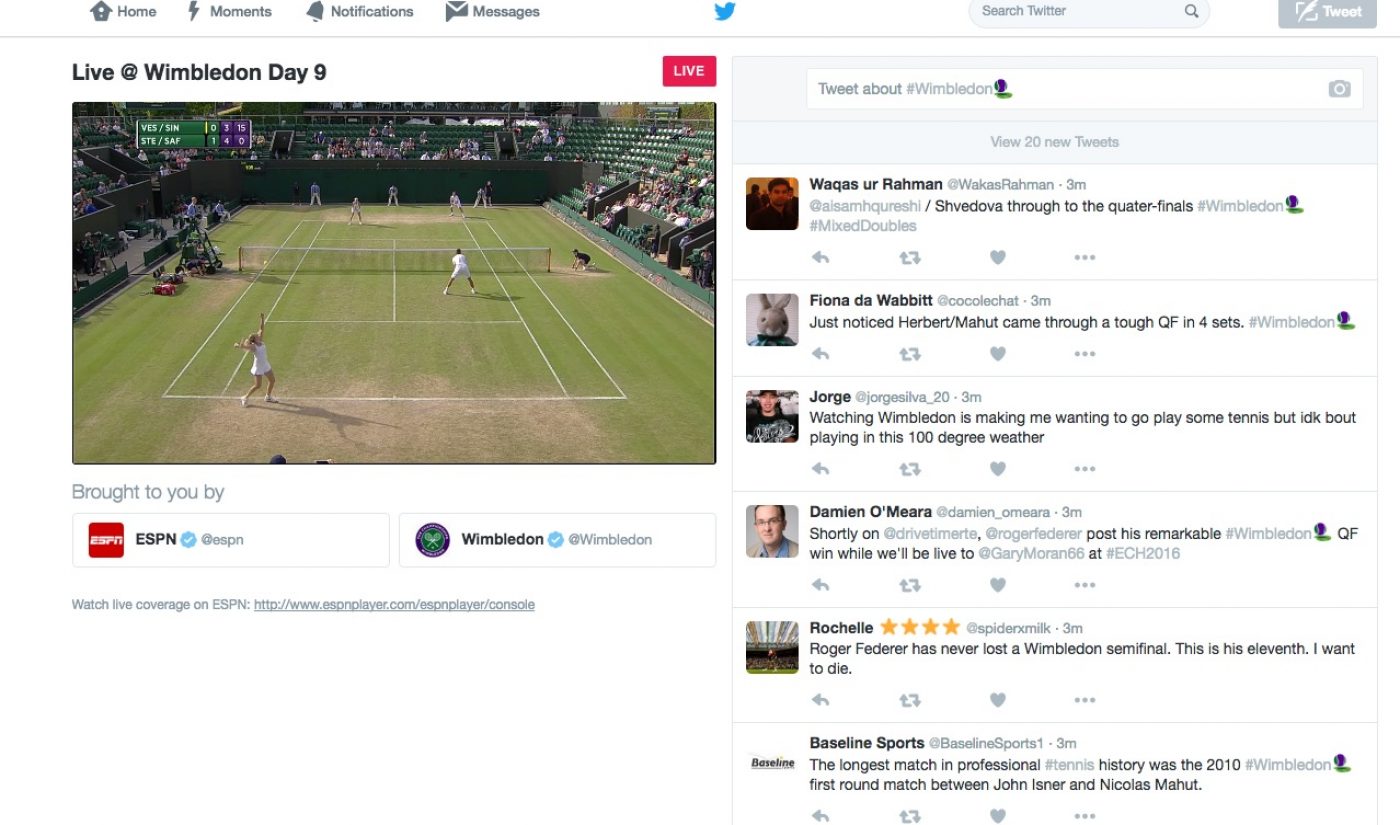

Witness Twitter’s string of live-streaming video deals with the major sports leagues, including NFL and MLB baseball games, highlights from Wimbledon and the NBA, college sports, and much else. For good measure, the social-media platform is live-streaming political conventions, Bloomberg TV business shows, and the scene from the red carpet for Warner Bros.’ Suicide Squad.

Can Twitter become the new ESPN? Maybe. I’m not convinced that people will use the site to watch sports, even if analytics sites routinely track hundreds of thousands of sports-related tweets each week as fans vent about their games of choice. But Twitter’s in-the-moment sensibility and ongoing conversations are indeed a better fit for live sports than, say, Facebook. Other sites aren’t standing still, of course. Snapchat is adding an NFL channel to its Discovery section just in time for the season. But as we watch more and more video on mobile devices, Twitter may be well positioned.

Meanwhile, the vaulting value of TV rights is driving sports mergers and acquisitions. Talent agency WME-IMG led a $4 billion acquisition of Ultimate Fighting Championships, once derided as “cock-fighting with humans.” Separately, several big media companies are bidding as much as $8 billion to buy just a piece of the Formula One racing empire.

Technology is changing more than how we watch sports on video screens. Levi’s Stadium, where this year’s Super Bowl was played, is as wired as the headquarters of any of its Silicon Valley neighbors. The Los Angeles Rams are spending an estimated $2.5 billion on their new stadium in Inglewood, part of the cost going to make it a technological marvel.

Los Angeles Clippers owner Steve Ballmer (also Microsoft’s former CEO and a major Twitter investor) created a stir at the recent Geekwire sports-tech summit when he talked about moving his NBA team to a new arena. Part of that desire, he said, was to better control the fan experience, currently managed by landlord AEG. The implication is that the Staples Center, which the industry named Arena of the Year when it opened 17 years ago, is already wildly out of date.

“What does technology enable…how does it let you do things differently?” Ballmer asked during the Geekwire talk. “We don’t own our arena, so a lot of things about the fan experience are not on our list. We get what we get from AEG.”

Ballmer said he’s a big fan of how technology can improve the fan experience, from augmented-reality technologies that annotate the action on the court to virtual-reality experiences that give a person in the nosebleed seats a view from courtside, or behind the basket, or anywhere else they want. That latter tech is called “the infinite seat,” putting a fan anywhere they want during a game, even if they’re not at the arena.

But technology also can improve more prosaic issues such as ticketing and getting food and drinks quickly, making the experience of attending a game easier and more enjoyable.

Ballmer is also an investor in Second Spectrum, an ambitious Los Angeles startup using machine-learning and “spatiotemporal” (aka motion in space over time) data to transform sports for players, coaches, fans, media and venues.

“What we’re trying to do specifically (with Second Spectrum and the Clippers) is to transform the fan experience,” Ballmer said. “I’m going to put my money where my mouth is. I made a loan, I made an investment, I’m a customer. We’re the first team with enough control over our rights to do something with them.”

A VR and advertising panel I attended last week at Vntana.com (whose clients include sports venues using its interactive holograms that let fans “play” against Derek Jeter or Roger Federer) featured top executives for the Clippers and AEG, which also owns fellow Staples tenant the NHL’s Kings. The two panelists quickly made clear their divergent incentives and definitions of how to improve the fan experience.

The Clippers want to engage team fans whether they’re physically at a game, watching it on TV at home, catching a live stream on their smartphone, or talking about the team between games online and off. Accordingly, they’re trying all kinds of things, including considering whether they create an online streamed channel instead of re-upping their expired contract with a regional sports network.

One example of the team’s tech-driven experiments, said Tavio Hobson, head of the team’s corporate sponsorships, was a partnership with a high-end carmaker to create virtual-reality experiences about the cars for the few hundred ticket holders with the arena’s best seats. “Even if you only reach 350 people in the stadium, they’ll tell their friends,” said Hobson.

For the venue owner (and AEG owns 120 properties around the world, including icons such as the O2 arena in London) deciding where to enhance the fan experience is definitely site specific. “You want to make that in-game fan experience special so they (the Clippers) keep selling out,” said Robert Thacker, who heads strategy analytics and digital marketing for AEG Global Partnerships.

So what else is coming? I got a glimpse of new ways to engage fans during a recent game featuring another AEG-owned team, the pro soccer L.A. Galaxy, and venue. Team sponsor Alcatel is not only buying ad space all over the StubHub Center in Carson, Calif., but has created a soccer emoji app and behind-the-scenes exclusive virtual-reality content featuring the team.

Further, Alcatel is packaging that content with the hardware it sells, like the Idol 4S, a $400 smartphone that debuted this week and comes bundled with its own matching VR goggles and an app called FYUSE that shoots 360-degree images. Tie the exclusive and immersive content from highly engaged sponsors and teams and we have a taste of what sports fandom will look like in a few years. Notice that the team and sponsor don’t need a mediating TV network to reach fans in compelling ways.

Other technologies promise to improve how athletes at all levels train, perform, and recover from injuries. One intriguing example was part of the tech accelerator that the Los Angeles Dodgers and R/GA launched in 2015.

FocusMotion, which counts Kobe Bryant among its investors, specializes in tracking all kinds of physical activities, from running to throwing to lifting weights, relying in part on multiple patents filed by its co-founders. The data is then used to determine optimum paths for each of those motions. The technology is getting built into training sensors, and promises to improve how people work out and perform in a wide range of athletic endeavors.

But for all its promise, the technology also sparks questions of privacy and who owns the data about a specific athlete. If a team uses the information to fine-tune a pitcher’s motion so the athlete is more effective and durable, that’s one thing. It’s another if the data also suggests the team should trade or not re-sign the pitcher because his motion is more likely to cause injuries.

“There is a Big Brother aspect to it,” FocusMotion CEO and co-founder Cavan Canavan acknowledged during another recent panel discussion. “Eventually, we’ll have data on every athlete from middle school to the pros.”

On top of that, as Ballmer said, no technologies for optimizing training have really caught fire yet with the people who matter most, the professional athletes.

“The key is to help the athlete and what that will lead to in terms of performance on the court,” Ballmer said. “Right now, the tech feels like it’s (being created) for its own sake. I’m not pessimistic about the tech. I just think we have a long way to go.”

This installment of Insights is brought to you by Beachfront RISE, the premier app building company that houses all of your content in one place for any device, and monetizes it automatically with their built in programmatic video advertising platform.

This installment of Insights is brought to you by Beachfront RISE, the premier app building company that houses all of your content in one place for any device, and monetizes it automatically with their built in programmatic video advertising platform.